kansas inheritance tax waiver

The only exception from this requirement is when the deceased died more than 10 years before the transfer. However most states provide various exemptions from the transfer tax such as transfers between parents and children.

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

For example New Jersey Illinois and New Hampshire are the top 3 US states with the highest property tax rates.

. The credit is equal to a maximum of 1100 for owners and 750 for renters. They did not own a motor vehicle on January 1st. Display all party information per instruments found.

Display one 1 party name per instruments found. 17-4912 Uniformity of interpretation. The transfer tax is usually a small percentage of the consideration or purchase price.

A person qualifies for a tax waiver when. A federal tax lien exists after. For full access to 85000 legal and tax forms customers just have to sign up and choose a subscription.

In this situation the beneficiary will owe taxes on the entire difference between what the owner paid for the annuity and the death benefit. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. On the other hand if the estate is large it may be well worth the time and money to challenge a will in probate court.

Download Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property from the US Legal Forms web site. They are a new resident to the State of Missouri or. The good news is that some states are better than others when it comes to the rate of property tax assessed and collected.

To qualify homeowners must be at least 65 years old and they must own and occupy their home. 17-4611 Waiver of notice. What is the Missouri property tax credit.

Article 49aUNIFORM TRANSFER ON DEATH SECURITY REGISTRATION ACT 17-49a01 Definitions. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. View and download Cumberland County forms and information by subject such as Adult Probation and Parole including DUI program Clerk of Courts criminal forms including subpoena and expungement District Attorney forms and information for alternative punishment and juvenile programs Domestic Relations.

10 States with the Lowest Property Tax in 2020. Consult a tax lawyer or. Other taxes such as federal income tax gift tax or inheritance tax may also accompany a quitclaim deed transfer.

A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. Display all matching names for the instrumentss found. Proof of inheritance tax lien release not required prior to transfer.

17-4612 Board of trustees. Federal and state fiduciary. This is the option with the highest tax.

The spouse could choose to take an immediate lump sum. What are the fees and costs. Seniors in Missouri may be eligible for a form of property tax relief called the Missouri property tax credit.

Court Forms and Other Information resources in Pennsylvania. 17-4913 Title of act. Full-year owners must.

Your lawyer can advise you on this. It maintains its tax-deferred status meaning the beneficiary owes no immediate taxes. Depending on the size of the potential inheritance and the complexity of the case the expense of a will contest may or may not be cost-effective.

It offers numerous professionally drafted and lawyer-approved forms and samples. No-Contest Clauses in Wills. Confirm you qualify for a tax waiver.

17-49a02 Registration in beneficiary form. Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance tax Waiver. Get help navigating a divorce from beginning to end with advice on how to file a guide to the forms you might need and more.

In light of the COVID-19 emergency the Assessors Office has implemented a procedure to request it online. Puts your balance due on the books assesses your. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

The only exception from this requirement is when the deceased died more than 10 years before the transfer. An American Airlines flight going across the country had to make an emergency landing in Kansas City Missouri on Sunday afternoon after a passenger allegedly caused a disturbance mid-flight. Get help navigating a divorce from beginning to end with advice on how to file a guide to the forms you might need and more.

A Tax Waiver can normally only be obtained in person at the Assessors Office. Once again states with no property tax dont really exist in the US housing market 2020. Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance Tax Waiver which is filed with the Register of Deeds in the county in which the property is located.

This is an option for other beneficiaries as well. The Waiver is filed with the Register of Deeds in the county in which the property is located. The lien protects the governments interest in all your property including real estate personal property and financial assets.

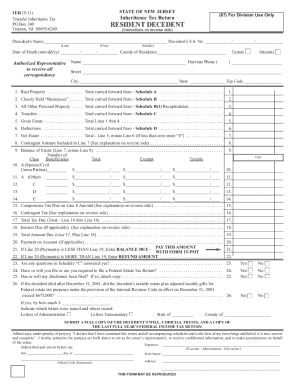

Nj It Nr 2010 2022 Fill Out Tax Template Online Us Legal Forms

Kansas And Missouri Estate Planning Inheritance Tax

Kansas And Missouri Estate Planning Inheritance Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Kansas Estate Tax Everything You Need To Know Smartasset

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

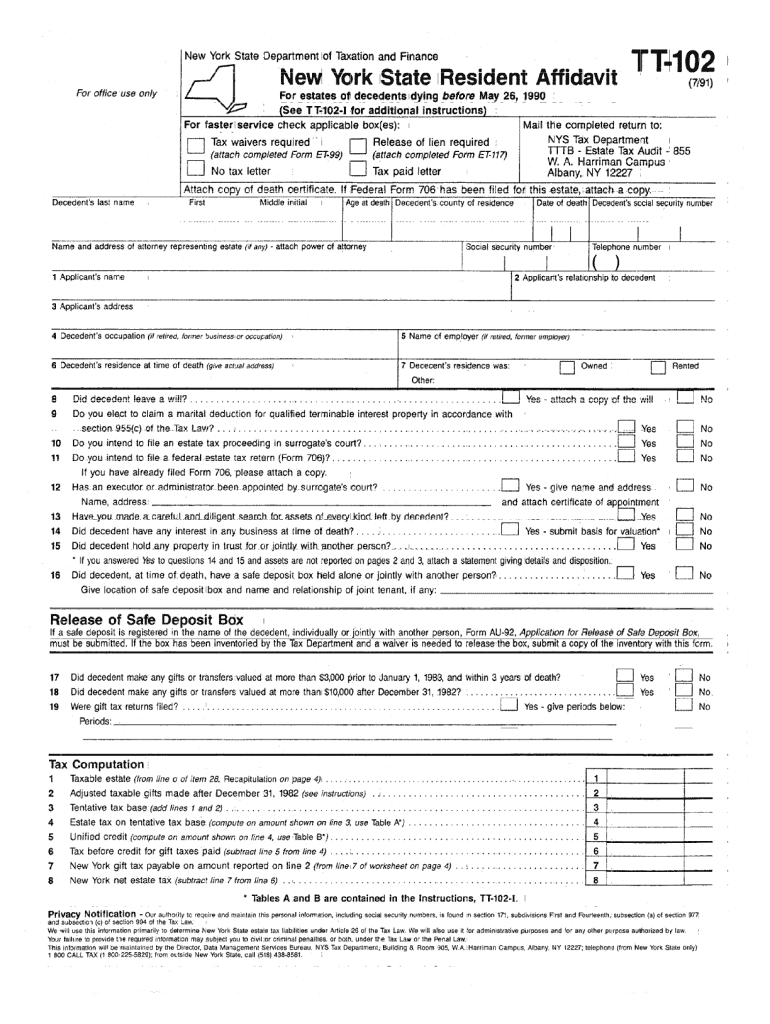

Ny Tt 102 1991 2022 Fill Out Tax Template Online Us Legal Forms

How To Use The Property Tax Portal Clay County Missouri Tax

Kansas Estate Tax Everything You Need To Know Smartasset

States With An Inheritance Tax Recently Updated For 2020

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nj Form It R Fill Online Printable Fillable Blank Pdffiller

What Is A Homestead Exemption And How Does It Work Lendingtree